The Chancellor announces £4.6 billion in new lockdown grants to support businesses and protect jobs.

Following news last night (4 January) that the UK will be placed in another national lockdown, the government have announced that they will be offering new lockdown grants to support businesses and protect jobs over the coming months. Businesses across the country in the leisure, retail and hospitality industries have been forced to close […]

HMRC reject calls to relax tax return deadline

HMRC has rejected calls from professional bodies to relax the self assessment filing deadline. Penalty notices will be issued as usual to all who file late but more time will be allowed to appeal. The Institute of Accountants in England and Wales (ICAEW) have reported that many accountancy practices have made contact with them in […]

Are You & Your Business Ready For Brexit?

The UK has left the EU and there are now only 10 days remaining before we will be forced to face new rules for business with the EU. Additionally, we will also be forced to face a range of different protocols, especially when planning to travel abroad. These may include renewing your passport, taking out […]

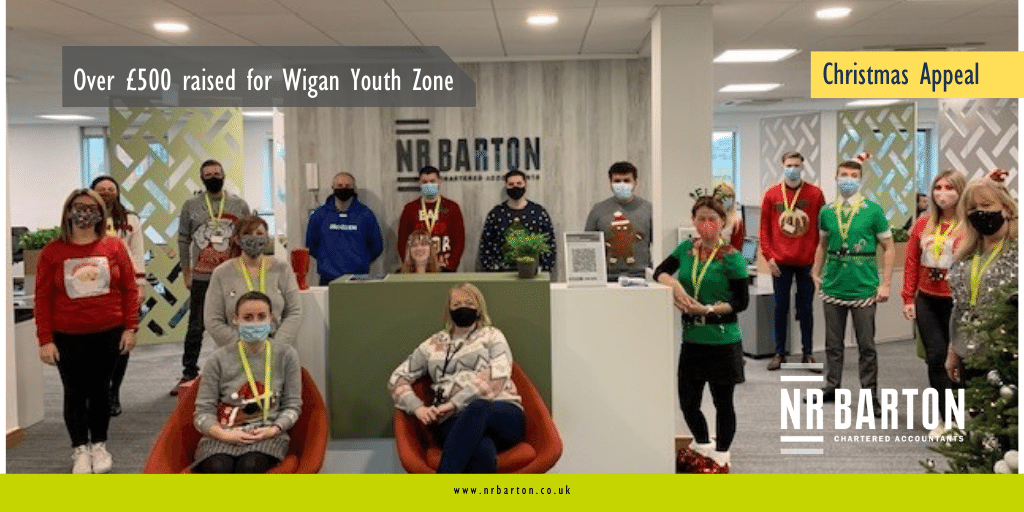

NR Barton Team Raise Over £500 For Wigan Youth Zone

Every year, a charity very close to our hearts (Wigan Youth Zone), makes a donation of perishable food and other domestic products to over 80 families across the Wigan borough. The restrictions imposed by Coronavirus have resulted in donations being slow so far this year. However, although things are different, the Christmas Festivities must still […]

NR Barton Christmas Appeal

2020 has undoubtedly been a very difficult year for people, businesses, and the economy. However, as we are approaching the Christmas season, it is important that we continue to make a positive impact in the local community, despite all the doom and gloom brought upon us by the COVID-19 pandemic. As such, here at NR […]

Self-Employment Income Support Scheme (SEISS) Grant Extension: Third Grant Available Soon

Article published on 26/11/2020 In light of recent decisions to put the UK into a 3-tiered lockdown system once again, the UK government are extending the SEISS so that a third grant will be available soon. The third SEISS will be made available to self-employed people who’s business have been affected by coronavirus (COVID-19). If […]

Rishi Sunak Releases the Main Points From the 2020 Spending Review

Rishi Sunak says the spending review comes as the coronavirus health emergency is not over and the economic emergency has only just begun. The Chancellor has said he will prioritise jobs, businesses and public services. He reported that the Government is spending £280bn to get the country through Covid-19. Next year, the government will allocate […]

Job Retention Scheme (CJRS) – Notice Periods

HM Treasury has confirmed that statutory and contractual notice periods will not be covered by the Coronavirus Job Retention Scheme from 1 December and that details of future claims will be published online. For claim periods starting on or after 1 December, employers cannot claim for any days between 1 December and 31 January 2021, […]

Are You Ready For New Rules For Business With The EU?

Published: 17/11/2020 Urgent message from the business secretary: “There is just over a month to go until the end of the transition period and there will be new rules to follow from 1 January 2021 onwards. As Business Secretary, as business secretary, I urge you to act now to avoid your business operations being interrupted […]

£1Million Annual Investment Allowance Extended

The Government have shared some good news that the current Annual Investment Allowance (AIA) of £1,000,000, which was due to revert down to £200,000 on 1 January 2021, will be extended for a further year to 1 January 2022. Businesses, including manufacturing firms, can continue to claim up to £1 million in same-year tax relief […]