How to defer payment of the March, May & June 2020 VAT returns

If you deferred VAT between 20 March and 30 June 2020 and still have payments to make, you can: pay the deferred VAT in full on or before 31 March 2021 opt in to the VAT deferral new payment scheme when it launches in 2021 contact HMRC if you need more help to pay […]

No Fine If Covid Makes You Miss Your Tax Return Deadline

You will no longer be fined for filing your tax return late if your business has been affected by coronavirus. These new rules will benefit millions of workers and will alleviate some pressure off many individuals. Those affected businesses that will not be able to file their tax returns by 31 January will be able […]

The Tampon Tax Has Been Abolished Within The UK

After a lot of dispute over recent years, the ‘tampon tax’ has been abolished. As a result, a zero rate of VAT now applies to women’s sanitary products as of 1 January 2021. This comes as part of the governments action to end Period Poverty which includes the roll out of free sanitary products in […]

The Chancellor announces £4.6 billion in new lockdown grants to support businesses and protect jobs.

Following news last night (4 January) that the UK will be placed in another national lockdown, the government have announced that they will be offering new lockdown grants to support businesses and protect jobs over the coming months. Businesses across the country in the leisure, retail and hospitality industries have been forced to close […]

Are You & Your Business Ready For Brexit?

The UK has left the EU and there are now only 10 days remaining before we will be forced to face new rules for business with the EU. Additionally, we will also be forced to face a range of different protocols, especially when planning to travel abroad. These may include renewing your passport, taking out […]

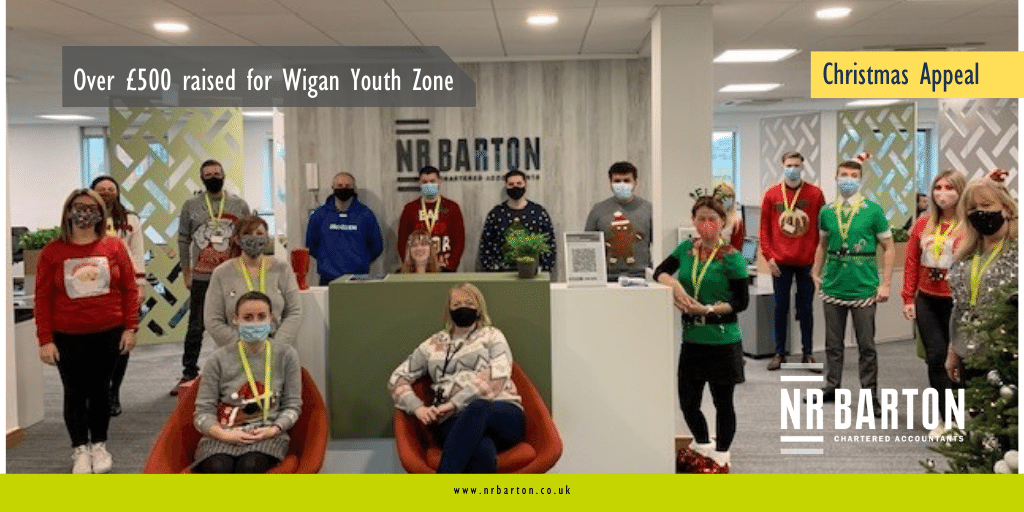

NR Barton Team Raise Over £500 For Wigan Youth Zone

Every year, a charity very close to our hearts (Wigan Youth Zone), makes a donation of perishable food and other domestic products to over 80 families across the Wigan borough. The restrictions imposed by Coronavirus have resulted in donations being slow so far this year. However, although things are different, the Christmas Festivities must still […]

New Government Coronavirus Scheme to Pay Up to Half of Wages

Today 22 October, Rishi Sunak has announced big changes to the Job Support Scheme (JSS) which has been set to replace the Furlough scheme in November. This has occurred due to many businesses being forced to shut in Tier 2 and Tier 3 areas. However, the Chancellor also expressed that many businesses which are not […]

The Job Retention Bonus

The Job Retention Bonus Make sure your employees are paid the minimum income threshold to be eligible for the £1,000 Job Retention Bonus. For employers to claim the £1,000 Job Retention Bonus for each employee that is still employed since being furloughed, they must be paid at least £1,560 of taxable pay in […]

HMRC opens portal for Working From Home expenses claims

The rise of coronavirus has resulted in businesses adapting to working from home, with many discovering that it can be just as effective as being in the office. Social distancing measures have resulted in many workplaces doing a rotational basis, where staff do part of the week in the office and the rest at home. […]

NR Barton Raise £200 for Macmillan Cancer Support

The team here at NR Barton are delighted to announce that through our socially distanced coffee morning, we were able to raise a total of £200 for Macmillan Cancer Support. The morning of 29 September 2020, the team generously baked and bought cakes to bring to the event (see featured pictures). Some of the home-made […]