Coronavirus (COVID-19): CBILS summary helpsheet

The Coronavirus Business Interruption Loan Scheme (CBILS) has been implemented to support long-term viable businesses who are looking to alleviate cashflow pressures through seeking finance. The finance will be provided by the British Business Bank through participating providers during the COVID-19 pandemic. The CBILS supports a wide range of business finance products, including term facilities, […]

Coronavirus (COVID-19): Business Interruption Loan Scheme Update

The Chancellor Rishi Sunak has today (3rd April) revealed the much needed overhaul to the Coronavirus Business Interruption Loan Scheme (CBILS) including an introduction of a new Coronavirus Large Business Interruption Scheme (CLBILS). The temporary loan scheme originally announced by the Chancellor on 23rd March has not been a success o date with many small […]

Coronavirus (COVID-19): HMRC extends MTD ‘digital links’ deadline

In light of the coronavirus pandemic HMRC have announced that businesses participating in Making Tax Digital for VAT have until 1 April 2021 to meet the requirement to have ‘digital links’ within their accounting systems. To ease the pressure during the COVID-19 crisis, HMRC has confirmed that it is allowing more time for participants in […]

Coronavirus (COVID-19): Companies House filing deadline delay

Companies House understand the current pressures on Companies and Directors in light of the Coronavirus pandemic. As such they have agreed to extend filing deadlines by three months as a measure of support. This extension must be applied for and is not automatic. Businesses must send their application to Companies House before their normal filing […]

NRB does lock down

Our amazing team are working remotely throughout this lock down period to make sure our clients are looked after at this difficult time. Watch their video here, hopefully it’ll put a smile on your face. We’re here to help With all the legislative changes and updates over recent days in these ever changing and […]

Coronavirus (COVID-19): Government support summary

These are testing times in which we live. With the Coronavirus (Covid-19) pandemic causing a ‘lockdown’ situation in the UK, the government have announced a host of measures to aide UK businesses to survive. To help business owners understand their options regarding Government support we have put together the booklet below. Click the image or […]

VAT liability payment deferral options

HMRC have announced temporary changes to the VAT payments due between 20 March 2020 and 30 June 2020 to help businesses manage their cash flow. Perhaps key to the advice is the recommendation that if you usually pay your VAT by direct debit then HMRC are recommending you CANCEL the direct debit to avoid the […]

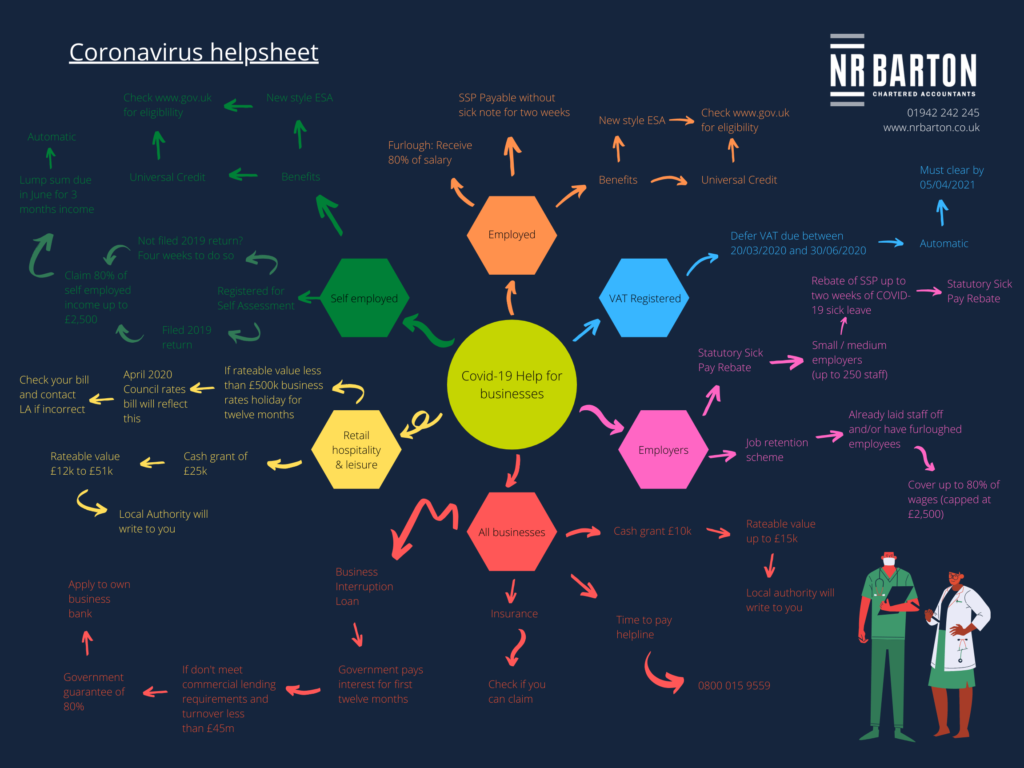

Coronavirus (COVID-19): Helpsheet

These are testing times in which we live. With the Coronavirus (Covid-19) pandemic causing a ‘lockdown’ situation in the UK, the government have announced a host of measures to aide UK businesses to survive. To help with this myriad of advice and incentives out there we have prepared a simple one page summary pdf. To […]

Coronavirus Self Employed Grants – Details

In line with the above guidance for the employed, HMRC have issued the detailed guidance for the grants available for the self employed. The details can be accessed on the HMRC website: https://www.gov.uk/guidance/claim-a-grant-through-the-coronavirus-covid-19-self-employment-income-support-scheme We’re here to help With all the legislative changes and updates over recent days in these ever changing and uncertain times, our […]

Coronavirus Job Retention (Furlough) Scheme – Full details now released

HMRC have issued the detailed guidance for the Coronavirus Job Retention (Furlough) Scheme. The details can be accessed on the HMRC website: https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme We’re here to help With all the legislative changes and updates over recent days in these ever changing and uncertain times, our teams are briefed and here to help you and your […]